Assessor's Office

The Rome/Floyd County Board of Assessors is the governmental entity responsible for the valuation of all the real and personal property in the city and county. The Assessors' Staff estimate fair market value to assure that the tax burden is distributed equitably and uniformly. Their primary goal is to ensure fair and objective appraisals.

Notification of Site Visits

In accordance with O.C.G.A 48-5-264.1, the Floyd County Board of Assessors must notify property owners prior to making a site visit. Said property visit will be for the purpose of determining the accuracy of the information contained in the county's appraisal record for the property.

Reasonable notice is hereby given that a representative of the county appraisal staff will review and physically inspect properties. The staff member should arrive in a clearly marked county vehicle and be prepared to provide identification upon request. Reasons for the site visit include, but are not limited to the following: Sale or purchase of property, new construction, active building permits, a return filed, an appeal filed, application for exemption filed, or a three year review visit as recommended by the Department of Revenue Appraisal Procedure Manual Rule 560-11-10-.09(2)(d)4(iii). These appraisal reviews will include measuring structures, listing construction information, and photographing the subject property.

2024 Assessment Notice Mailing

Each year in accordance with O.C.G.A. § 48-5-306 (c) the Board of Assessors must furnish a listing of real and personal property accounts whose annual notice of assessment was returned un-deliverable. The Floyd County Board of Assessors mailed the 2024 property assessment notices to all property owners on record Friday, May 14, 2024. If you own property in Floyd County and do not receive an assessment notice, please contact our office. Each property listed will have 30 days from the date of posting to file an appeal on the value of the property. Failure to properly access the listing and file an appeal accordingly will not result in an extension by the Floyd County Board of Assessors.

The assessment notice will reflect the current property value and will also include an estimate of the upcoming property tax which will be based on the 2023 millage rates. Please do not attempt to pay the amount on the notice. It is not a tax bill and there will be a statement to that effect printed on the assessment notice.

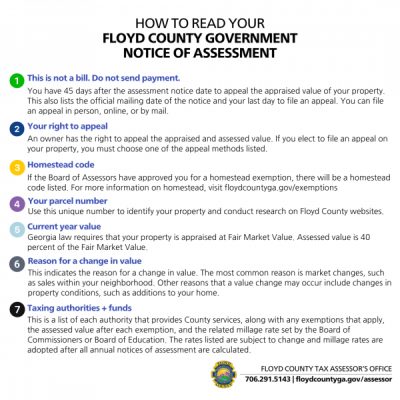

HOW TO READ YOUR FLOYD COUNTY ANNUAL NOTICE OF ASSESSMENT

Property owners who feel their property value is incorrect should file a written appeal. The amount of the estimated property tax cannot be the basis for an appeal. Property owners have 45 days from the date of the notice to file their appeal. If an appeal is not received by our office, or postmarked by the stated deadline, it will not be accepted as a valid appeal.

There are four methods to file an appeal and each is referenced on the notice. One of the methods must be selected and a valid opinion of value must also be stated by the property owner. The deadline to file an appeal for 2024 will be Friday, June 28, 2024.

Appeals should be addressed to:

Floyd County Board of Assessors

4 Government Plaza, Suite 203

Rome, Ga. 30161-2803

The letter should include the map reference from the assessment notice, the elected method of appeal, an estimate of what the value should be, a brief reason for the appeal and a daytime phone number.